What Is Mandatory Substitution-and Why Does It Matter?

When a law forces you to replace one thing with another, that’s mandatory substitution. It’s not about preference. It’s about control. And it’s happening in ways you might not realize-in your bank’s trading systems, in mental health courts, and even in the chemicals used in your shampoo.

Across the world, governments are using mandatory substitution as a tool to reduce risk, protect rights, or clean up the environment. But the rules aren’t the same anywhere. What’s required in Brussels isn’t even allowed in New York. What’s considered a human rights violation in one country is standard practice in another.

This isn’t theoretical. It affects how banks manage billions in loans. It determines whether someone with a psychiatric diagnosis can make their own medical decisions. It shapes what ingredients end up in consumer products. And understanding these differences isn’t just for lawyers or regulators-it’s for anyone who lives under these systems.

Banking: The Hidden Rule That Changed How Trillions Are Lent

In 2021, a little-known rule in the European Union’s Capital Requirements Regulation (CRR) forced banks to stop using certain types of collateral in short-term lending deals. The rule? Mandatory substitution. Instead of counting the value of the original asset backing a loan-say, a corporate bond-banks had to treat the tri-party agent (a middleman) as the actual borrower.

Why? Regulators feared that if the original issuer defaulted, banks wouldn’t be able to quickly recover their money. By substituting the exposure to the agent, they thought they’d make the system safer. But banks pushed back hard. J.P. Morgan reported a 15-20% spike in operational costs. Mid-sized institutions spent an average of €1.2 million each just to update their software. The Association for Financial Markets in Europe called it “not prudent from a risk management perspective.”

The U.S. didn’t follow. The Federal Reserve, FDIC, and OCC kept their own rules. They said standardized substitution didn’t capture real risk. They kept using internal models-tools banks built themselves. That created a gap. EU banks had to change everything. U.S. banks didn’t. And that gap became a loophole: 22% of EU financial firms moved some trading operations to London after Brexit to avoid the new rule.

The result? A $2.1 billion market for regulatory tech tools that help banks navigate these conflicting systems. And a world where the same financial product carries different risk profiles depending on where it’s traded.

Mental Health: Who Gets to Decide for You?

In Ontario, if someone is deemed unable to make their own medical decisions due to mental illness, a family member or court-appointed guardian can step in. That’s called substitute decision-making. It’s legal. It’s common. And under the Convention on the Rights of Persons with Disabilities (CRPD), it’s increasingly seen as a violation.

The CRPD, ratified by 182 countries, says people with disabilities have the right to equal recognition before the law. That includes the right to make their own choices-even bad ones. But many countries still allow courts to override a person’s will if they’re labeled “incapable.”

Canada signed the CRPD in 2007 but kept a reservation: it still allows substitute decision-making. Australia did the same. England and Wales continue to use the Mental Capacity Act (2005), which lets doctors and families make decisions without the patient’s consent. Meanwhile, Ontario’s system is considered one of the most rights-based in the world-yet even there, frontline workers say supported decision-making (where help is offered, not forced) is nearly impossible for people with severe cognitive impairments.

Some countries are shifting. Australia is moving toward supported models. The UK’s 2023 Mental Health Act reform proposes cutting compulsory interventions by 30%. But full implementation is delayed until 2026. In the meantime, 68% of countries still rely on some form of mandatory substitution in mental health law.

The tension is real. Harvard Law’s Michael Ashley Stein argues the CRPD bans all substitute decision-making. But without clear alternatives, many systems are stuck. The result? People are still being treated against their will-not because they’re dangerous, but because the law says someone else knows better.

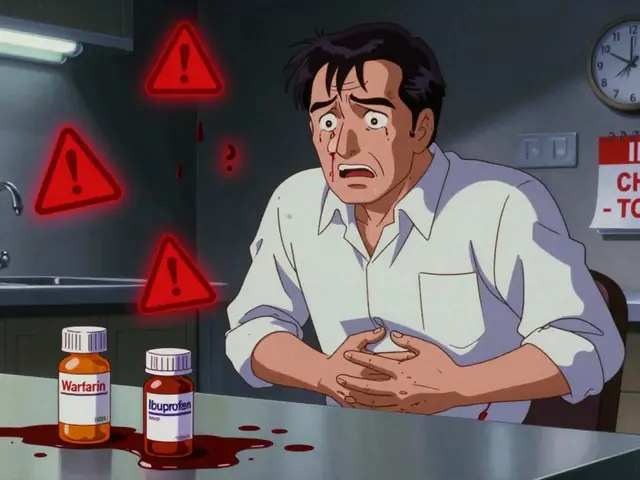

Chemicals: The Hidden Cost of Safer Products

Ever wonder why some ingredients disappeared from your cleaning products or cosmetics? That’s mandatory substitution at work-under the EU’s REACH regulation.

REACH forces companies to find safer alternatives to chemicals classified as “substances of very high concern.” Think carcinogens, hormone disruptors, or persistent toxins. If you use one, you need to prove you can control the risk-or replace it. The process is brutal: applications cost an average of €47,000 per product. Sixty-two percent of initial submissions get rejected because the alternative isn’t “suitable” enough.

But it’s working. BASF cut substances of very high concern in its product lines by 23% since 2016. The global market for safer chemical alternatives is now $14.3 billion. Sweden’s PRIO list and ChemSec’s SIN List-voluntary tools that flag dangerous chemicals-have pushed companies to act even before the law demands it.

But not everyone can keep up. Small businesses struggle with the cost and complexity. And while the EU is expanding these rules-adding 27 new substances in 2023 and requiring substitution planning for all restrictions by 2025-the U.S. and many other countries have no equivalent. That means a product safe enough to sell in Germany might be banned there but still sold in the U.S. with no warning.

Companies now design separate product lines just for the EU. That’s not innovation. That’s regulatory fragmentation.

Why Do These Rules Diverge So Much?

It’s not just about safety or rights. It’s about power, history, and economic pressure.

In finance, the EU moved fast because it saw tri-party repo deals as a hidden vulnerability after the 2008 crisis. The U.S. held back because its banks had invested billions in internal risk models-and they didn’t want to scrap them.

In mental health, countries with strong patient advocacy movements-like Canada and Australia-are slowly moving toward supported decision-making. But places with deeply rooted medical paternalism still see substitute decision-making as necessary for “protection.”

And in chemicals, the EU leads because it treats environmental and health risks as public rights. The U.S. treats them as industry concerns. That’s why the REACH system is one of the strictest in the world-and why many U.S. companies lobby to avoid adopting similar rules.

There’s no global standard. No universal definition. Just a patchwork of laws, each shaped by local politics, industry influence, and cultural attitudes toward risk and autonomy.

What’s Next? The Future of Mandatory Substitution

Looking ahead, these systems won’t disappear. They’ll evolve.

In finance, the Basel Committee still allows optional substitution. The EU keeps it mandatory. That gap will widen. Banks will keep shifting operations to avoid compliance costs. Regulators will keep demanding better data. And fintech firms will keep building tools to bridge the divide.

In mental health, the pressure from the CRPD will grow. More countries will face lawsuits. More courts will be forced to confront the contradiction between protecting people and denying them control. Supported decision-making is the future-but it needs funding, training, and cultural change. Right now, it’s an ideal, not a reality for most.

In chemicals, the EU’s 2022 Chemicals Strategy for Sustainability will push substitution into more product categories. Other countries will either adopt similar rules-or become dumping grounds for banned substances. The global market for safer alternatives will keep growing, but so will the cost of compliance.

One thing’s clear: mandatory substitution isn’t going away. But who gets to decide what gets replaced-and why-depends entirely on where you live.

Frequently Asked Questions

Is mandatory substitution the same as voluntary substitution?

No. Mandatory substitution is required by law-companies or institutions must replace something, or face penalties. Voluntary substitution happens when a company chooses to switch to a safer or cheaper alternative on its own, without legal pressure. For example, under REACH, companies must substitute certain chemicals (mandatory), but many also remove other ingredients to improve their brand image (voluntary).

Why does the EU enforce mandatory substitution more strictly than the U.S.?

The EU follows the precautionary principle: if there’s a plausible risk, act before harm occurs. The U.S. typically waits for clear evidence of harm before regulating. This difference shapes everything-from chemicals to financial rules. The EU sees substitution as a public health and safety tool. The U.S. sees it as a potential burden on business.

Can mandatory substitution in mental health be challenged legally?

Yes. In countries that have ratified the CRPD, individuals or advocacy groups can challenge substitute decision-making in courts or human rights bodies. Cases have already been brought in Canada, Australia, and the UK arguing that forced guardianship violates Article 12. Courts are slowly starting to side with these arguments, but change is slow because existing laws are deeply embedded in legal systems.

How do companies cope with conflicting substitution rules across countries?

Many create separate product lines or financial products for different regions. A chemical company might sell one version of a cleaner in the EU with banned substances removed, and a different version elsewhere. Banks may route certain trades through offices in jurisdictions with looser rules. This increases costs but avoids legal risk. It’s not efficient-but it’s safer than breaking the law.

Are there any benefits to mandatory substitution?

Yes. In finance, jurisdictions with mandatory substitution saw 18% lower systemic risk in IMF studies. In chemicals, REACH has driven innovation, leading to over 23% reduction in toxic substances in EU products. In mental health, some argue substitute decision-making prevents harm in acute crises. The problem isn’t the goal-it’s the lack of nuance. One-size-fits-all rules often ignore context, leading to unintended consequences.

9 Comments

Rachel Wusowicz

Nov 15 2025So... they're forcing banks to use middlemen instead of bonds? And no one's asking why the middlemen are the same companies that helped cause 2008? This isn't regulation-it's a shell game with €1.2 million receipts. And don't get me started on the "safer" chemicals... they just swap one poison for another that no one's tested yet. I've seen the MSDS sheets. The new ones have "proprietary blend" written in 14-point font. They're not protecting us-they're protecting the audit trails. And the mental health stuff? Oh, please. "Supported decision-making"-yeah, right. Until your guardian gets a cut of your disability check. I'm not paranoid. I've read the contracts.

Melanie Taylor

Nov 16 2025This is wild 😮 I live in the US and had NO IDEA the EU was doing this with chemicals and banking. Like... I just thought they were all about broccoli and yoga, but now I see they're basically running a global regulatory experiment. And we're just sitting here with our toxic shampoo and loose financial rules? 😅 Maybe we need to steal their playbook... or at least their shampoo.

Teresa Smith

Nov 16 2025The divergence in regulatory philosophy between the EU and the U.S. reflects fundamentally different societal priorities. The EU operates under the precautionary principle-prioritizing systemic integrity and public health even in the absence of conclusive evidence. The U.S. adheres to a risk-benefit calculus grounded in empirical validation and economic efficiency. This is not a matter of superiority, but of epistemological and cultural framing. The consequence is fragmentation, yes-but also innovation in compliance architecture. The $2.1 billion regulatory tech market is not a bug; it is the emergent infrastructure of global governance.

Latrisha M.

Nov 17 2025I've worked in compliance for 15 years. The EU rules are brutal but they work. The U.S. system lets banks play games with their own models. One time, a client used a model that assumed default rates would drop 70% because of "market sentiment." I told them it was nonsense. They said, "But it's our model." That's the problem. Mandatory substitution isn't perfect-but at least it forces transparency. Stop calling it overreach. It's just accountability with a deadline.

Jamie Watts

Nov 19 2025You guys are overthinking this. The EU is just jealous because their banks are trash. They can't compete so they make up rules to make everyone else look bad. And the mental health stuff? People who can't even tie their shoes shouldn't be deciding if they get insulin. Give me a break. The U.S. does it right-let the professionals handle it. You want autonomy? Go live in a cave. The rest of us want safety. And the chemicals? If you want to pay 50% more for soap that smells like lavender and lies then go ahead. I'll take the real stuff.

John Mwalwala

Nov 19 2025Let me break this down in layman’s terms. Mandatory substitution is the deep state’s playbook. In finance, they replace collateral with agents to centralize control. In mental health, they replace patient autonomy with state-appointed guardians to eliminate dissent. In chemicals, they replace toxins with undisclosed nano-ingredients that bypass testing. The common thread? Eliminate transparency, increase dependency, and outsource decision-making to entities that answer to no one. The CRPD? A distraction. The real agenda is systemic disempowerment. And they’re doing it under the banner of "safety." Classic. The EU is not a leader. It’s the vanguard.

Deepak Mishra

Nov 19 2025OMG I just read this and my mind is BLOWN!!!! Like seriously!!! I'm from India and we have NO idea how much the EU is controlling the world!!! I mean... my shampoo has banned chemicals but my phone charger has lead??? And my cousin in Canada got forced into mental care because she cried at work??!! 😭 This is not justice this is... like... a dystopian Netflix show!!! Who's funding this??? 🤔 #MindBlown #RegulationIsAlien

Diane Tomaszewski

Nov 21 2025It’s funny how we talk about control like it’s always bad. But sometimes, someone else knowing better actually saves lives. My dad had dementia. He refused insulin. The doctors stepped in. He lived another five years. I’m not saying every rule is right. But blanket opposition to substitution ignores the people who can’t speak for themselves. The real issue isn’t the rule-it’s whether we’re building real alternatives or just yelling about freedom.

Dan Angles

Nov 21 2025The institutional inertia surrounding mandatory substitution is not merely a regulatory phenomenon-it is a manifestation of the tension between liberal autonomy and paternalistic governance. The legal frameworks described reflect not merely policy divergence, but ontological differences in the conception of personhood. Where the EU treats the individual as embedded within a collective responsibility, the U.S. treats the individual as a sovereign agent. Neither is inherently superior. But the absence of a transnational framework ensures that compliance arbitrage will persist, and the vulnerable will continue to bear the cost of jurisdictional fragmentation. A unified definition of substitution, grounded in human dignity rather than economic efficiency, remains the most urgent legal imperative of our time.