Medicaid spends billions each year on prescription drugs, but here’s the surprising part: generic drugs make up 85% of all Medicaid prescriptions - yet only 16% of the total drug spending. That’s because generics are cheap. But even cheap drugs can add up when you’re covering 80 million people. So states are stepping in with smart, sometimes bold, strategies to keep those costs from spiraling - without cutting off access to essential medicines.

How Medicaid Gets Its Generic Drug Discounts

The federal government set up the Medicaid Drug Rebate Program (MDRP) back in 1990. It’s simple: drug makers get their medicines covered by Medicaid, and in return, they pay rebates. For brand-name drugs, those rebates are big - up to 25% of the price. But for generics? The law says manufacturers must pay at least 13% of the average price they charge hospitals and pharmacies. That’s it. No room for negotiation. No state can ask for more.

That’s a problem. Because while the rebate helps, it doesn’t stop manufacturers from hiking prices on old, off-patent drugs. Think of a 50-year-old blood pressure pill that costs pennies to make. One company starts charging $100 a pill. Another copies it. Then they all raise prices together. No competition. No oversight. And Medicaid pays the bill.

States Fight Back With Maximum Allowable Cost Lists

Forty-two states now use something called a Maximum Allowable Cost (MAC) list. It’s basically a price cap. If a generic drug costs more than the state’s MAC limit, Medicaid won’t pay the full price. The pharmacy gets paid the MAC amount - not what the wholesaler charged.

States like California, Texas, and New York update their MAC lists every month. Others do it quarterly. The problem? Prices for generics can swing fast. If a state updates too slowly, a pharmacy might get stuck selling a drug at a loss. A 2024 survey found 74% of independent pharmacies had claims rejected or delayed because their MAC list didn’t match real-time prices.

It’s a balancing act. Too high, and states waste money. Too low, and pharmacies stop stocking the drug. Patients lose access. That’s why 31 states now update their MAC lists at least quarterly - trying to stay ahead of price spikes.

Mandatory Generic Substitution - Almost Everywhere

Forty-nine states require pharmacists to swap a brand-name drug for a generic - if it’s approved and available. This isn’t optional. If your doctor prescribes Lipitor, but there’s a generic version of atorvastatin, the pharmacist must offer it unless you or your doctor say no.

This policy alone saves states hundreds of millions each year. It’s one of the most effective tools in the toolbox. But it only works if generics are actually in stock. And that’s where things get messy.

Price Gouging Laws: Stopping the Sneaky Hikes

In 2020, Maryland passed a law that made it illegal to jack up prices on generic drugs without a good reason. No new clinical data? No cost increase? No supply shortage? Then you can’t raise the price. If you do, the state can fine you.

That law became a model. Now, six other states - including Colorado, Nevada, and Vermont - have similar rules. The idea is simple: generics aren’t supposed to be profit machines. They’re supposed to be affordable. When a company buys an old drug for $100 and sells it for $1,000, it’s not innovation. It’s exploitation.

But the drug industry fights back. Lawsuits are common. Manufacturers argue these laws interfere with free markets. So far, courts have mostly let them stand - as long as they’re clear and targeted.

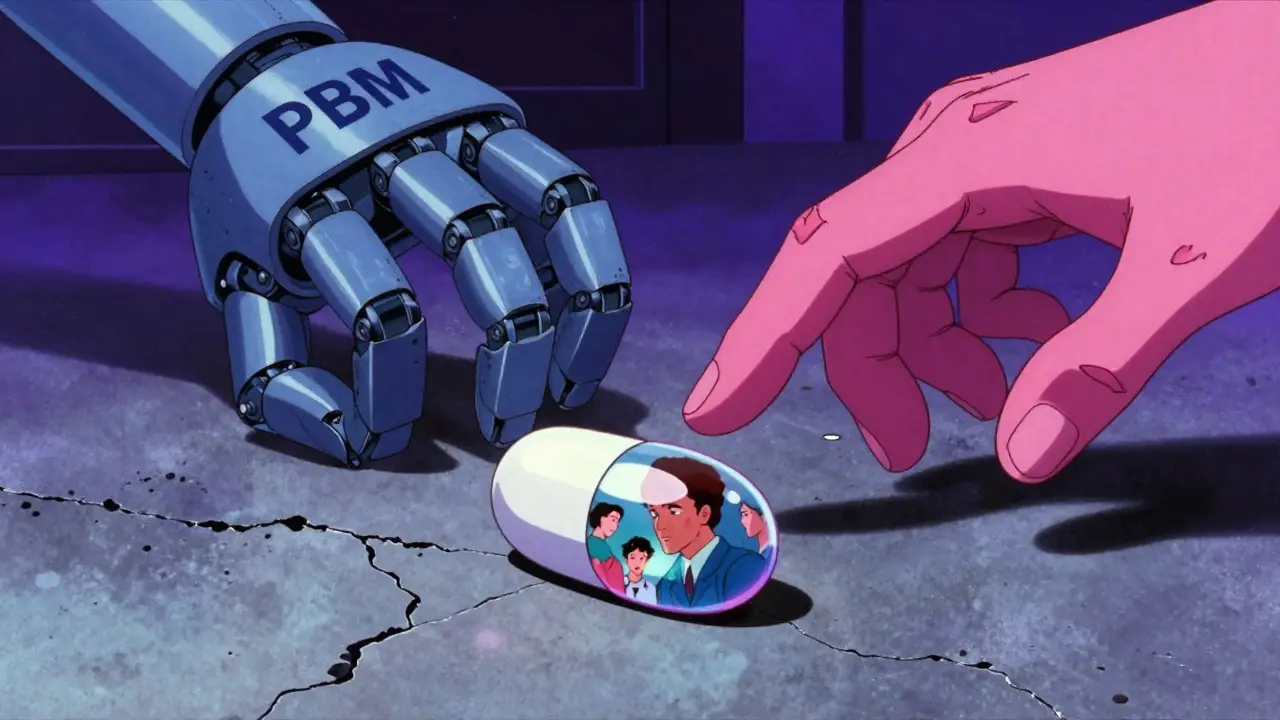

Pharmacy Benefit Managers (PBMs): The Middlemen You Never Knew About

Most states don’t pay pharmacies directly. They hire companies called PBMs - like OptumRx or Magellan - to manage drug benefits. These middlemen negotiate prices, set reimbursement rates, and collect rebates. But here’s the catch: they don’t always pass savings on to the state.

In 2024, 27 states passed new rules forcing PBMs to show exactly how much they paid for generics. Before, many PBMs hid the real cost behind “spread pricing” - charging Medicaid $50 for a pill that cost them $10, keeping the $40 difference. Now, 19 states require PBMs to disclose their actual acquisition cost. That’s transparency. And it’s starting to cut costs.

Supply Chain Problems Are Making Things Worse

Twenty-three states reported shortages of critical generic drugs in 2023. Some lasted over four months. Why? Because making generic drugs isn’t profitable enough. A few big companies control most of the market. Three firms now make two-thirds of all generic injectables. If one shuts down a factory - for quality issues, labor problems, or just because it’s not profitable - the whole country feels it.

Twelve states passed laws in 2024 to fix this. They’re building stockpiles of essential generics. Some are partnering with other states to buy in bulk. Oregon and Washington started a multi-state pool to negotiate better prices on 47 high-volume generics. It’s working. They saved 18% on insulin, metformin, and antibiotics.

The Big Challenge: Don’t Break the System

Everyone agrees: generic drugs are the backbone of Medicaid’s drug budget. But there’s a risk. If states push too hard - setting price caps too low, cutting reimbursements too fast - manufacturers will stop making those drugs. Then patients go without. Hospitals scramble. Costs go up anyway.

A 2024 Congressional Budget Office report warned that overly aggressive price controls could reduce generic availability by 5-8%. That might sound small. But if patients switch to brand-name drugs or ER visits spike because they can’t afford their meds, Medicaid ends up spending more.

Experts like Dr. Mark Duggan from Stanford say the answer isn’t to eliminate rebates - it’s to improve them. He suggests tying rebates to drug shortages. If a generic runs out, the rebate should go up. That gives manufacturers a reason to keep making them - even if profits are thin.

What’s Next? More State Action, Fewer Federal Rules

The federal government isn’t stepping in. CMS recently shelved its own drug pricing plan. That means states are on their own. And they’re moving fast.

By 2025, 15 more states plan to introduce laws targeting generic drug prices. Nine states already have Prescription Drug Affordability Boards that can cap prices on any drug - brand or generic - if it’s deemed unaffordable. Minnesota uses federal Inflation Reduction Act rules to set payment limits. California is testing value-based payments for generics - paying more if the drug keeps patients out of the hospital.

And it’s not just about price. States are now looking at the whole chain: who makes the drug, where it’s made, how it’s shipped, and who gets it. The goal? A reliable supply of affordable medicines - not just cheaper bills.

Bottom Line: Generics Are the Key - But Only If They’re Available

Medicaid’s biggest cost saver isn’t a new drug. It’s not a fancy tech system. It’s the simple, old-fashioned generic pill. But keeping those pills cheap and in stock isn’t automatic. It takes constant monitoring, smart rules, and the courage to stand up to big pharma.

States are learning fast. They’re not trying to control every price. They’re trying to stop abuse. They’re not trying to cut access. They’re trying to protect it. And so far, the results are clear: when states act, costs go down - and patients still get their medicine.

How do Medicaid generic drug rebates work?

Under the Medicaid Drug Rebate Program, drug manufacturers must pay a rebate of at least 13% of the Average Manufacturer Price (AMP) for generic drugs. This is a federal requirement - states can’t negotiate higher rebates for generics, unlike with brand-name drugs. The rebate helps reduce what Medicaid pays, but it doesn’t stop manufacturers from raising prices.

What is a Maximum Allowable Cost (MAC) list?

A MAC list is a state-set price cap for generic drugs. If a pharmacy charges more than the MAC amount, Medicaid only pays the MAC price. Forty-two states use MAC lists to control costs, but updating them too slowly can cause pharmacies to lose money or stop stocking certain drugs.

Why are generic drug shortages happening?

Three major companies control 65% of the generic injectables market. When one factory shuts down - due to quality issues, low profits, or supply chain problems - shortages spread. Many generics aren’t profitable enough to justify production, so manufacturers exit the market. Twelve states are now stockpiling critical generics to prevent this.

Can states stop companies from price-gouging generics?

Yes. Nine states, including Maryland and Colorado, have laws that penalize manufacturers for unjustified price hikes on generic drugs - especially when there’s no new clinical data or cost increase. These laws are being tested in court, but most have been upheld so far.

Do Pharmacy Benefit Managers (PBMs) make generic drugs more expensive?

Some do. PBMs act as middlemen and used to hide their profits through “spread pricing” - charging Medicaid more than they paid the pharmacy. Now, 19 states require PBMs to disclose their actual acquisition cost, which is helping reduce hidden markups and increase transparency.

Will state drug pricing laws reduce generic drug availability?

Possibly. The Congressional Budget Office warns that overly aggressive price controls could lead manufacturers to stop making certain generics. If patients can’t get cheap drugs, they may turn to more expensive alternatives, increasing overall Medicaid costs. The key is balance - lowering prices without breaking the supply chain.

8 Comments

astrid cook

Jan 26 2026So let me get this straight - we’re letting companies charge $100 for a pill that costs 2 cents to make, and we call it capitalism? 😒 This isn’t healthcare, it’s a hostage situation with a pharmacy receipt.

Kirstin Santiago

Jan 27 2026I’ve seen this play out in my mom’s life. She’s on Medicaid, takes metformin and lisinopril - both generics. Last year, her copay jumped from $3 to $27 because the MAC list was outdated. She skipped doses. I didn’t even know until her HbA1c went through the roof. States need to update these lists weekly, not quarterly. Lives are on the line, not spreadsheets.

Candice Hartley

Jan 28 2026PBMs are the real villains here 🤦♀️ I had no idea they were pocketing $40 on a $10 drug. Why do we even have them? Just cut out the middleman and pay pharmacies directly. Simple. 🙏

Kegan Powell

Jan 29 2026you know what i think the real issue is not the price gouging or the mac lists or even the pbms its the fact that we treat medicine like a commodity when its a human right you know like why are we even debating this like if you need insulin to live why does profit matter at all why does anyone get to decide if you live or die based on a balance sheet its not capitalism its cruelty dressed up as economics

April Williams

Jan 31 2026This is why I can’t stand Medicaid. You let these greedy drug companies run wild, then you blame the state for trying to fix it? Wake up. If you’re making $1,000 pills from $100 investments, you’re a thief. And if your state doesn’t fine you, it’s complicit. I’ve had to beg for my asthma inhaler because the pharmacy ran out - because the rebate didn’t cover the new price. This isn’t policy. It’s betrayal.

Harry Henderson

Jan 31 2026Enough with the slow motion. We need a federal price cap NOW. Not next year. Not after another lawsuit. States are wasting time playing nice. Pharma’s laughing. Patients are dying. Let’s nationalize generic manufacturing. Build our own factories. Screw the lobbyists. This isn’t a debate - it’s a war for survival.

suhail ahmed

Feb 2 2026In India, we have a phrase - ‘dawa ka bazaar nahi, jeevan ka bazaar hai’ - medicine isn’t a market, it’s a life market. These U.S. states? They’re doing what they can with broken tools. But here’s the kicker: if you want to stop price spikes, stop letting three companies control 65% of injectables. Break up the oligopoly. Let small labs compete. Let generics be generic again - not corporate monopolies in disguise. The solution isn’t just price control. It’s market justice.

Paul Taylor

Feb 3 2026I’ve been in pharmacy for 27 years and let me tell you the MAC lists are a nightmare most states update them like once a quarter and prices change every week some days you get paid less than you paid for the bottle and you still have to pay rent and payroll and if you say anything the state says you’re overcharging but the truth is if you don’t stock the drug patients go without and if you do you lose money its a lose lose and the worst part nobody in government ever comes to the back room to see the shelves half empty and the receipts piling up and the pharmacists crying because they know someone’s going to skip their insulin again and they can’t do anything about it