By the end of 2024, millions of Medicare beneficiaries will face a final year of the donut hole-a confusing and costly phase in Medicare Part D where you pay more out of pocket for prescriptions. But here’s the good news: starting January 1, 2025, the donut hole disappears completely. A new $2,000 annual out-of-pocket cap kicks in, meaning no matter how expensive your meds are, you won’t pay more than that in a year. If you’re currently hitting the coverage gap, you have time to act before the system changes forever.

What the Donut Hole Actually Means in 2024

The donut hole isn’t a hole you fall into randomly-it’s a specific phase in your Medicare Part D plan. Once you and your plan have spent $5,030 on covered drugs in 2024, you enter the coverage gap. You’re not off the hook yet. You still pay 25% of the cost for both brand-name and generic drugs. Sounds manageable? It’s not. Here’s why: that 25% is only part of the story.For brand-name drugs, the manufacturer pays a 70% discount, but that discount doesn’t go into your pocket-it counts toward getting you out of the gap. For generics, there’s no manufacturer discount. So if you’re on a $1,000-a-month brand-name drug like Humira, you pay $250 a month out of pocket. But because of the 70% discount, your total drug cost is counted as $1,000, not $250. That means you’re moving faster toward catastrophic coverage, but you’re still paying $250 every month. For someone on multiple expensive meds, that adds up to $3,000 or more in a single year.

How the $2,000 Cap Changes Everything in 2025

Starting January 1, 2025, the entire structure flips. There’s no more donut hole. Instead, you have three phases:- Deductible (up to $590 in 2025): You pay full price until you hit this.

- Initial coverage: You pay 25% of drug costs until your total out-of-pocket hits $2,000.

- Catastrophic coverage: Once you hit $2,000, you pay $0 for covered drugs for the rest of the year.

This is huge. No more surprises. No more choosing between insulin and groceries. If your meds cost $8,000 a year, you still pay only $2,000. The rest is covered by your plan and manufacturers. And manufacturers? They’ll pay a 10% discount during initial coverage and 20% during catastrophic coverage-no more 70% discounts counting toward your out-of-pocket total. The system is simpler, fairer, and designed to protect you.

Who Gets Hit Hardest by the Donut Hole Right Now?

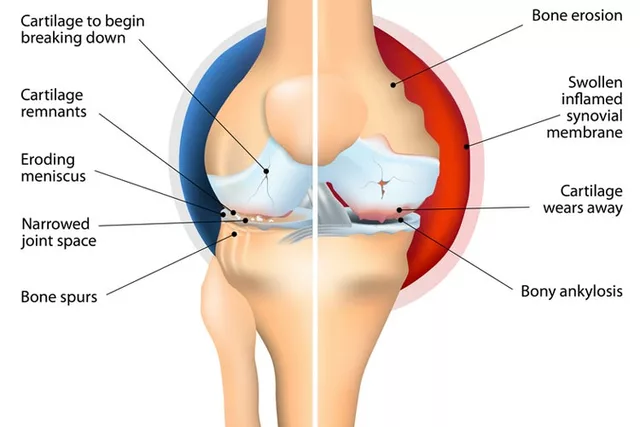

It’s not everyone. In 2022, only about 24% of Medicare Part D enrollees reached the coverage gap. But those who did? They were mostly people on high-cost drugs for chronic conditions: rheumatoid arthritis, multiple sclerosis, cancer, or severe diabetes. A Reddit user named u/SeniorCareAdvocate, a Medicare counselor with over a decade of experience, shared a common story: a client paying $1,200 a month for Humira during the donut hole. That’s $14,400 a year. Even with the 25% coinsurance, they’re still paying $3,600 annually-just for one drug.People on generics aren’t spared either. If you’re taking multiple generic drugs-say, blood pressure, cholesterol, and thyroid meds-you might not hit the gap until you’ve spent $6,000 out of pocket. But if you’re on a mix of brand and generic, you’re stuck in the middle: paying more than you should, with no clear way to predict when the bill will spike.

Five Proven Ways to Lower Your Costs Before 2025

You don’t have to wait until next year. Here’s what actually works right now:1. Check Your Drug Tier

Every Part D plan puts drugs into tiers. Tier 1 is cheapest (usually generics). Tier 3 or 4? That’s where the expensive brand-name drugs live. If your drug is on Tier 4, you’re paying more than you need to. Call your plan or log into Medicare Plan Finder and search your exact medication. You might find a similar drug on a lower tier that your doctor can switch you to.2. Use Manufacturer Patient Assistance Programs

Most big drug companies have programs that cut your cost by 60-90%. Amgen’s Repatha program helped one user drop from $560 to $5 per month during the donut hole. Eli Lilly, Novo Nordisk, AbbVie-all have them. Go to the drug’s official website and look for “Patient Assistance” or “Support Program.” You’ll need your prescription, income info, and Medicare number. It takes 1-2 weeks to enroll, but it’s free.3. Switch to Generic When Possible

Ask your doctor: “Is there a generic version?” For example, the brand-name drug Lipitor (atorvastatin) costs $300 a month. The generic? $10. That’s $3,480 in savings per year. Even if your plan covers the brand, the generic is almost always cheaper. And in the donut hole, generics have no manufacturer discount-so you’re paying full retail. Switching early saves you more.4. Get 90-Day Supplies

Most plans charge less for 90-day supplies through mail-order pharmacies. A 30-day copay of $40 becomes a 90-day copay of $100. That’s a 15-25% drop per prescription. If you’re on three meds, that’s $1,000+ saved a year. Ask your pharmacist or log into your plan’s website to switch.5. Apply for Extra Help (Low-Income Subsidy)

If your income is under $21,870 (individual) or $29,580 (couple) in 2024, you qualify for Extra Help. This program pays your Part D premiums, deductibles, and eliminates the donut hole entirely. About 12.6 million people qualified in 2023-but nearly half didn’t apply. You can apply online at SSA.gov or call 1-800-MEDICARE. It takes 1-3 months to process, so apply now.What to Do After January 1, 2025

Once the $2,000 cap starts, you’ll need to adjust your strategy:- Keep taking your meds. No need to ration or skip doses.

- Review your plan’s 2025 Annual Notice of Change (sent in September 2024). Your premiums might drop, or your formulary might change.

- Use the Medicare Plan Finder again. With the new cap, the cheapest plan isn’t always the one with the lowest premium-it’s the one with the best coverage for your specific drugs.

- Don’t assume your current plan is still the best. Some plans may raise premiums to offset the loss of manufacturer discount revenue.

Common Mistakes People Make

Most people don’t realize they’re in the donut hole until they get a bill they can’t afford. Here’s what to avoid:- Waiting until you hit the gap to act. By then, you’re already paying more than you should.

- Believing you’re not eligible for Extra Help. Many people think they make too much, but the limits are higher than you think.

- Not checking for manufacturer programs. If you’re on a brand-name drug, there’s almost always a discount program you haven’t heard of.

- Sticking with the same plan year after year. Plans change every January. What was cheap last year might be expensive now.

- Skipping doses to save money. This leads to hospitalizations, which cost far more than your meds.

Real Stories, Real Savings

One woman in Ohio, 72, took three drugs: Humira ($1,200/month), Metformin ($15/month), and Lisinopril ($8/month). In 2024, she hit the donut hole in May. Her monthly out-of-pocket jumped to $300. She applied for Extra Help in June. By July, her Humira cost dropped to $10. She saved $3,000 that year. Another man in Florida, 68, took a brand-name diabetes drug and a generic cholesterol med. He didn’t know about manufacturer discounts. After talking to a pharmacist, he enrolled in the program and cut his monthly cost from $450 to $45. He’s now saving $5,000 a year.What’s Next After 2025?

The $2,000 cap is just the beginning. Experts predict future reforms will lower premiums further and expand access to low-cost generics. The Medicare Payment Advisory Commission estimates the new cap will reduce prescription abandonment by 18-22%, saving the system $1.2 billion a year in avoided ER visits and hospital stays.The donut hole was a flaw in a system designed to help. It wasn’t meant to force seniors to choose between their health and their rent. The 2025 change fixes that. But until then, you have tools, programs, and options. Use them.

What happens if I don’t reach the donut hole in 2024?

If you don’t reach the coverage gap, you’re not affected by the donut hole at all. You’ll keep paying your regular copay or coinsurance until you hit the catastrophic coverage threshold ($8,000 in 2024). But you still benefit from the 2025 changes-the $2,000 out-of-pocket cap applies to everyone, regardless of whether you hit the gap in 2024.

Can I switch Medicare Part D plans mid-year?

Normally, you can only switch during the Annual Enrollment Period (October 15-December 7). But if you qualify for Extra Help or move to a new state, you can switch at any time. If you’re in the donut hole and your drug costs are unbearable, you can also apply for a Special Enrollment Period through Medicare if your plan changes coverage or your costs spike unexpectedly.

Do state programs help with the donut hole?

Yes. Thirty-seven states run Medicare Savings Programs that help low-income beneficiaries pay premiums and out-of-pocket costs. These programs don’t directly cover the donut hole, but they can reduce your overall drug spending, helping you avoid entering the gap. Check with your State Health Insurance Assistance Program (SHIP) for free local counseling.

Are all drugs covered under the $2,000 cap in 2025?

Only drugs on your plan’s formulary are covered. If your drug isn’t covered, it doesn’t count toward your $2,000 cap. That’s why it’s critical to review your plan’s drug list before 2025. If your current meds aren’t covered, you’ll need to switch plans or request an exception.

Will my premiums go up in 2025?

The average monthly Part D premium is projected to be $34.70 in 2025-slightly lower than 2024. While some plans may raise premiums to offset lost manufacturer discount revenue, the overall trend is downward. The $2,000 cap reduces risk for insurers, which helps keep premiums stable.

If you’re on expensive meds, don’t wait until next year to act. Use the tools you have now. Apply for help. Switch to generics. Call your plan. The system is changing-and you’re not powerless in the middle of it.

12 Comments

Wendy Lamb

Feb 4 2026Just applied for Extra Help last week-got approved in 10 days. My Humira went from $320 to $0. If you’re struggling, don’t wait. It’s not rocket science. Just fill out the form. Seriously.

Antwonette Robinson

Feb 4 2026Oh wow, so now we’re just handing out free medicine like it’s Halloween candy? Next they’ll pay for my Netflix subscription too. The system’s collapsing, folks.

Ed Mackey

Feb 5 2026got the 90-day script for my blood pressure med last month-saved me like $120. didn’t even know you could do that. thanks for the tip, OP. also, i misspelled ‘copay’ in the form but they still processed it. lol

Alex LaVey

Feb 5 2026This is exactly why I tell my neighbors not to fear change. The donut hole was a relic-a bureaucratic glitch that punished people for being sick. The $2,000 cap isn’t just policy, it’s dignity. I’ve seen folks skip insulin for weeks. Now? They can breathe again. Keep sharing this info. It saves lives.

Joseph Cooksey

Feb 6 2026Let’s be real-this whole ‘donut hole’ narrative was manufactured by pharmaceutical lobbyists who realized they couldn’t keep gouging seniors without backlash. The 70% manufacturer discount counting toward out-of-pocket? That was a sleight of hand. A shell game. Now, with the cap, they’re forced to eat their own profits. And honestly? Good. They’ve been laughing all the way to the bank while grandmas ration pills. This isn’t charity-it’s justice delayed, but finally arriving.

Justin Fauth

Feb 8 2026Y’all are crying about $2,000? I paid $18K for my kid’s chemo in ’08 and got zip. This country’s got it backwards. If you’re on Medicare, you paid into this system your whole life. You deserve this. Stop acting like it’s a handout. It’s your damn money.

Daz Leonheart

Feb 8 2026I was terrified of the donut hole. Thought I’d lose my house. Then I found out my plan had a $500 discount coupon just for switching to generic lisinopril. Changed everything. You don’t need to be a genius-just a little stubborn. Keep asking questions.

Mandy Vodak-Marotta

Feb 9 2026So I’m 65 and on 6 meds. Two brand-name, four generics. Last year I hit the gap in March. My monthly bill jumped from $210 to $650. I cried in the pharmacy aisle. Then I found out my insulin had a patient program that cut it to $35. I cried again-but this time because I could finally sleep. I wish someone had told me this sooner. Don’t wait. Call the drug company. Call your pharmacist. Call your neighbor who’s been through it. They’ll help. You’re not alone.

Alec Stewart Stewart

Feb 10 2026My mom got Extra Help last year. She’s on metformin, glipizide, and a cholesterol pill. Her total out-of-pocket dropped from $2,800 to $120. She’s been eating better, walking more, and actually going to her doctor appointments. That’s the real win-not just the money. It’s peace of mind.

Samuel Bradway

Feb 12 2026Just wanted to say thanks for writing this. My dad didn’t know any of this stuff. He thought he had to pay whatever the bill said. I printed this out and we went through it together. He’s now on a 90-day supply and enrolled in a patient program. He hugged me. That’s worth more than any savings.

Prajwal Manjunath Shanthappa

Feb 12 2026How quaint. A $2,000 cap? How utterly… pedestrian. In my country, we have universal healthcare-no donut holes, no formularies, no corporate discounts masquerading as benevolence. You Americans treat medicine like a luxury good, then wonder why your system collapses. This ‘solution’ is merely a Band-Aid on a hemorrhage. At least in India, we don’t pretend the market is moral.

Kunal Kaushik

Feb 13 2026Just got approved for Extra Help 😭 Thank you for this guide. My Humira went from $1,100 to $0. I didn’t even know I qualified. 🙏❤️